What is Index Trading?

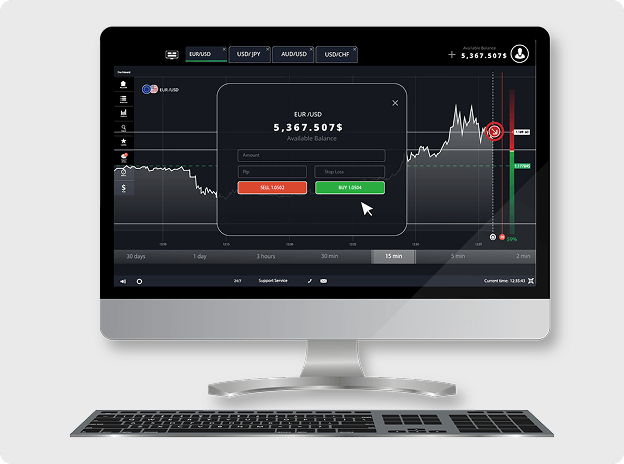

Index trading involves speculating on the performance of a group of stocks representing a particular market or sector. Through Contracts for Difference (CFDs), Skadeva enables you to trade on the price movements of major global indices without owning the underlying assets. This approach offers flexibility and access to a diverse range of markets.

Why Trade Index CFDs with Skadeva?

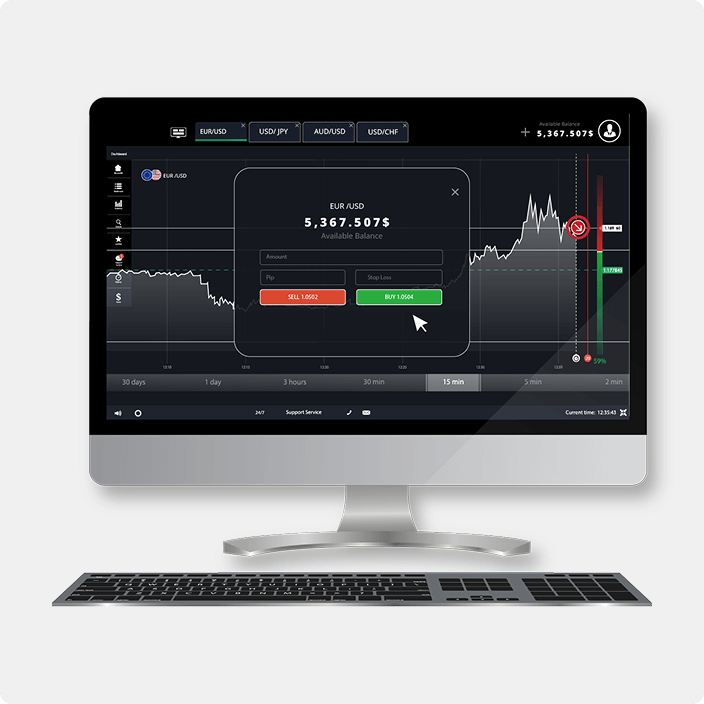

Global Market Access: Trade on major indices from around the world, including the US, Europe and Asia. Leverage Opportunities: Utilize leverage up to 1:200 to amplify your trading positions, while managing risk effectively. Advanced Trading Tools: Benefit from real-time data, analytical tools and customizable charts to inform your strategies. Secure and Reliable Platform: Trade confidently on Skadeva's platform, backed by robust risk management protocols and cutting-edge security measures.

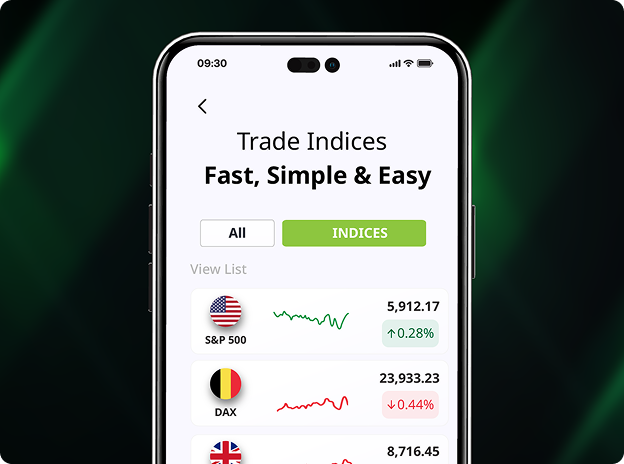

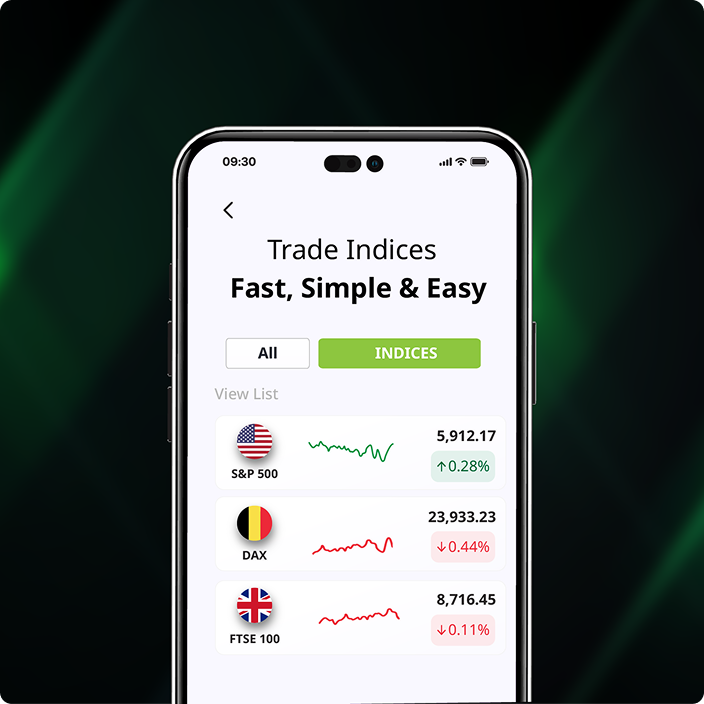

How to Start Trading Index CFDs with Skadeva

Select Your Index: Choose from Skadeva’s extensive list of global indices that align with your trading strategy. Develop a Trading Strategy: Utilize our educational resources to craft a strategy that aligns with your financial goals and risk tolerance. Execute Your Trade: Place your trades using our intuitive platform, equipped with real-time data and analytical tools. Monitor and Adjust: Keep track of your positions and adjust your strategy as market conditions evolve.

Stay Ahead of the Market with Skadeva Tools

Track trends, analyze data and manage your trades confidently. Our integrated tools are designed to help you make informed decisions every step of the way.

Open Account

Indices Offered by Skadeva

| Symbols | Description | Leverage (Up to) | |

| AUD200 (Australia 200 Cash Index) | The Australian 200 Cash Index, also known as the ASX 200, is a market-capitalization-weighted index measuring the performance of the top 200 companies listed on the Australian Securities Exchange (ASX). | 1:200 | |

| DE40 (Germany 40 Cash Index) | The Germany 40 Cash Index represents the top 40 publicly traded companies in Germany, providing insights into the performance of the German economy and stock market. | 1:200 | |

| ES35 (Spain 35 Cash Index) | The Spain 35 Cash Index tracks the 35 largest and most liquid Spanish stocks, offering exposure to Spain's equity market and economy. | 1:200 | |

| F40 (France 40 Cash Index) | The France 40 Cash Index includes the top 40 French stocks listed on Euronext Paris, reflecting the performance of the French equities market. | 1:200 | |

| JP225 (JPN225) | The JPN225, commonly referred to as the Nikkei 225, is a stock market index for the Tokyo Stock Exchange, comprised of 225 large-cap Japanese companies. | 1:200 | |

| N25 (Netherlands 25 Cash Index) | The Netherlands 25 Cash Index monitors the performance of the 25 leading Dutch companies traded on Euronext Amsterdam, providing exposure to the Dutch stock market. | 1:200 | |

| STOXX50 (Euro 50 Cash Index) | The Euro 50 Cash Index, also known as the EURO STOXX 50, represents 50 of the largest blue-chip stocks in the Eurozone, offering a broad benchmark for Eurozone equity markets. | 1:200 | |

| SWI20 (Switzerland 20 Cash Index) | The Switzerland 20 Cash Index comprises the top 20 Swiss stocks traded on the Swiss Exchange, reflecting the performance of the Swiss equity market. | 1:200 | |

| UK100 (UK 100 Cash Index) | The UK 100 Cash Index, also known as the FTSE 100, tracks the performance of the top 100 companies listed on the London Stock Exchange, showcasing the UK's equity market. | 1:200 | |

| USTEC (NAS100) | The NAS100, or NASDAQ-100, comprises 100 of the largest non-financial companies listed on the Nasdaq Stock Market, providing exposure to the tech-heavy U.S. market. | 1:200 | |

| US500 (SPX500) | The SPX500, commonly known as the S&P 500, includes 500 of the largest publicly traded companies in the U.S., offering a comprehensive view of the U.S. stock market. | 1:200 | |

| US30 (Dow Jones 30) | The Dow Jones 30 represents 30 large-cap U.S. companies, serving as a gauge of the overall health of the U.S. stock market. | 1:200 |

Start Your Index Trading Journey with Skadeva

At Skadeva, we believe that knowledge is the key to successful index trading. Our comprehensive trading tools are here to help you understand market dynamics, develop effective trading strategies and manage risks. Whether you're a new or an experienced trader, our resources are designed to support your growth.

Take the Next Step in Trading Now

Skadeva gives you the power and confidence to move forward in the markets.

Important information:

Thank you for visiting Skadeva. Please note that Skadeva does not accept traders from your country